In 1996, the journal EQM published an article called “Greening the Zebra” by E2M’s President, Lynn Johannson. She outlined the challenge of ‘greening’ the world of finance for financial institutions. Lynn used the ecological relationship between the zebra and the tsetse fly to explain the story of risk that the world of finance faced. This analogy still holds.

Fast forward to 2021, what progress has been made?

There are key stakeholders in the financial world who are now taking decisive action based on the realization that capital, in all its forms, is at risk.

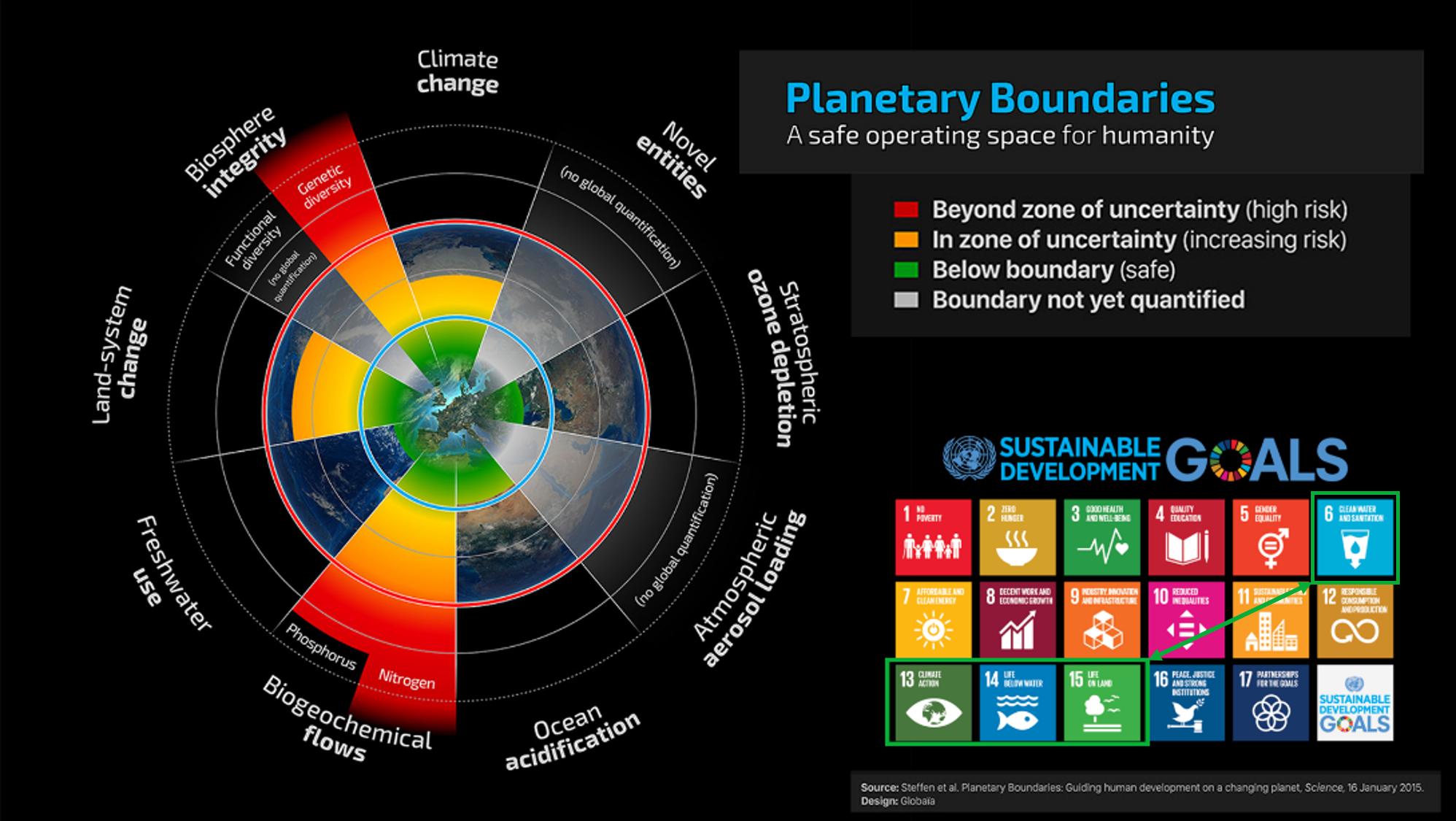

The 2020 World Economic Forum Global Risk Report identified the top five risks in terms of their likelihood as extreme weather, climate action failure, natural disasters, biodiversity loss, and human-made environmental disasters. In 2021, seven top risks were identified: extreme weather, climate action failure, human environmental damage, infectious diseases, biodiversity loss, digital power concentration, and digital inequality.

Unfortunately, not everyone understands that any environmental risk, not just climate risk, is a core concern for any company, regardless of size, sector or situation. The investment community is growing nervous about how climate risk will impact both our physical world and the global system that finances economic activities. While more innovation-oriented companies are responding to investor concerns, they often start with the short-term concerns associated with transition risks. Given the rapid changes that the financial world is experiencing, directors are and should be held accountable and responsible for the oversight of strategy, risk management and integrity of issues that are environmentally significant and material.

However, the reality and enormity of the challenge requires each and every person to take stock of their own environmental impacts and performance, and make radical changes in their personal and work habits.